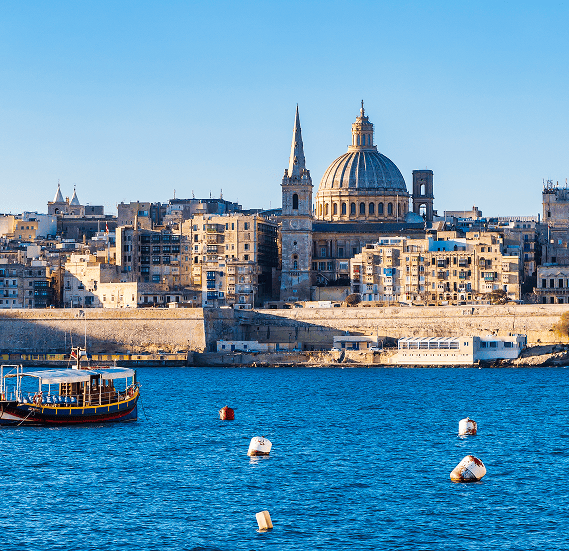

- Malta

- Tax Services Malta

- Malta Tax System

- Double Taxation Relief

Double Taxation Relief

Overseas Malta Tax

The overseas tax suffered may be allowed as a credit against tax chargeable in Malta on the gross amount, limited to the total tax liability in Malta on the particular income. Unilateral relief for underlying tax suffered is also available under these provisions where the taxpayer holding shares in the foreign company is a Maltese resident company.

Malta Europe

Malta is a full member of the EU since 2004 and the protection against double taxation afforded by the EU Parent Subsidiary Directive and the EU Interest and Royalties Directive may be availed of by Maltese companies. The flat rate foreign tax credit (FRFTC) is available to a Maltese resident company which receives income or capital gains from overseas which are allocated to its Foreign Income Account. This credit is calculated at 25% of the amount of the overseas income or gains received by the company before deductions and it provides double taxation relief for foreign tax suffered on income received from a country with which Malta does not have a treaty and where unilateral relief is not available, e.g. where evidence of foreign tax on the overseas income is not available or is not presented. In practice the flat rate foreign tax credit also acts as a means of unilateral tax sparing relief in respect of foreign tax suffered at lower rates.

Resources & Insights

Contact Us

01

MALTA

- Papilio Services Limited 168 St Christopher Street, Valletta, VLT 1467, Malta, Europe

- +35622582000

- enquiries@papilioservices.com