- Malta

- Tax Services Malta

- Personal Tax

Malta Personal Tax Advisor

Malta tax residence programmes are only obtainable through the services of an Authorised Registered Mandatory. As Authorised Mandatories (ARM00905), we can help our clients obtain Malta tax residence.

Malta Personal Tax Advisor

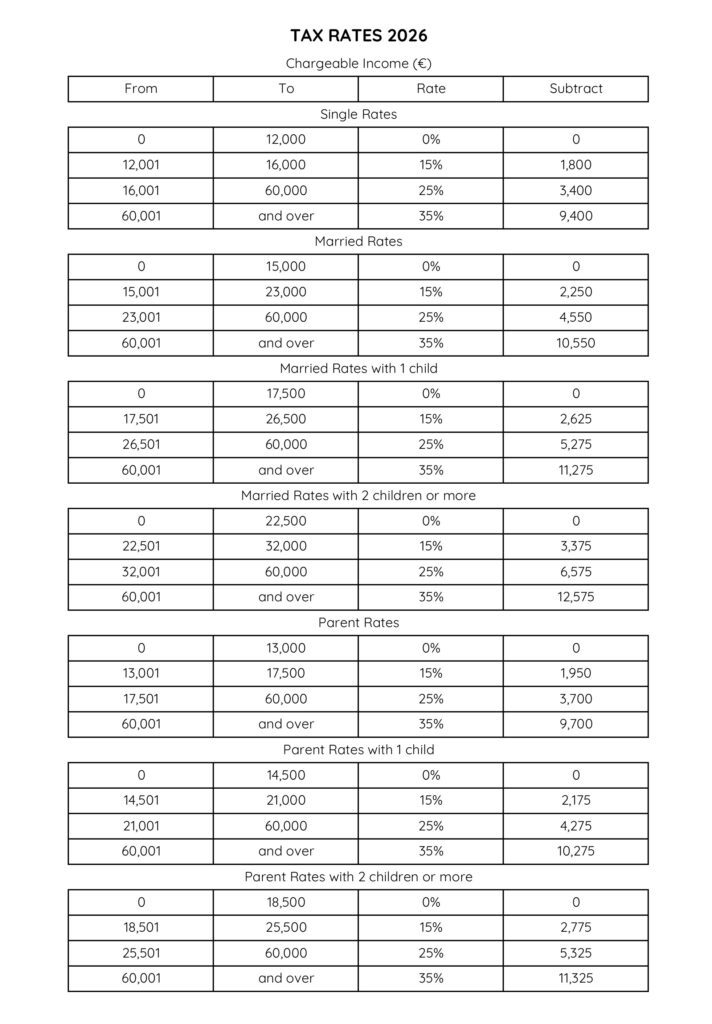

Malta income tax rates work off a progressive tax rate, meaning that the more income you generate, the more tax you pay. In short, the Malta income tax rates for 2026 are:

While Malta does have a progressive income tax system, there are tax residence programmes available for individual’s and expats in Malta.

There are two tax residence programmes in place for an individual that sets the tax rate on income remitted into Malta at 15%. This programme is ideal for travelling executives or those who intend on remitting dividends or capital gains. Moreover, this programme has no minimum stay requirement in Malta. These programmes are:

Malta Global Residence Programme (GRP)

for Non-EU/EEA/Swiss nationals

Malta Residence Programme (TRP)

for EU/EEA/Swiss nationals

The Highly Qualified Persons Rules is a programme available to all nationals. The programme seeks to attract highly qualified persons in the financial, gaming and aviation sectors by offering a 15% flat rate of tax on income generated in Malta. This programme can be extended up to 10 years and can only be undertaken by individuals working in an eligible office.

Retiring in Malta is a goal for many retirees. Malta is popular because of the climate, sunshine, Maltese culture, and the fantastic standard of living. As of 2020, the Malta Retirement Programme is available to all nationals.

The Malta Retirement Programme sets tax rate on pension income remitted to Malta at 15% so long as the pension income constitutes at least 75% of your taxable income.

EU/EEA/Swiss nationals may apply for Economic Self Sufficiency in Malta. You would have to prove that you can support a lifestyle without the need to be employed by a company in Malta. This can be proven by either showing significant savings or provide proof that you are in receipt of some form of income outside of Malta (such as pension income).

The minimum tax liability for Economic Self Sufficiency is €5,000 per annum. This covers annual income of up to €35,000 remitted into Malta.

Malta has over 80 double taxation agreements with countries around the world.

There are no withholding taxes or stamp duty on the distribution of

Malta has no transfer pricing rules.

There are no capital duties, wealth taxes or inheritance tax.

Malta has no thin cap rules.

Resources & Insights

Contact Us

01

MALTA

- Papilio Services Limited 168 St Christopher Street, Valletta, VLT 1467, Malta, Europe

- +35622582000

- enquiries@papilioservices.com